Are you carrying high balances on your high-interest credit cards? You’re not alone. By the end of 2022, Americans’ total credit card balance was $925 billion and according to data collected by LendingTree, the national average card debt among cardholders with unpaid balances was $6,569 and Americans carried a balance on 53% of all active credit card accounts.

Of course, we know carrying a balance has downsides, from paying high interest to impacting your credit score.

So how do you pay off your credit card debt as quickly as possible while paying the absolutely minimum in interest fees?

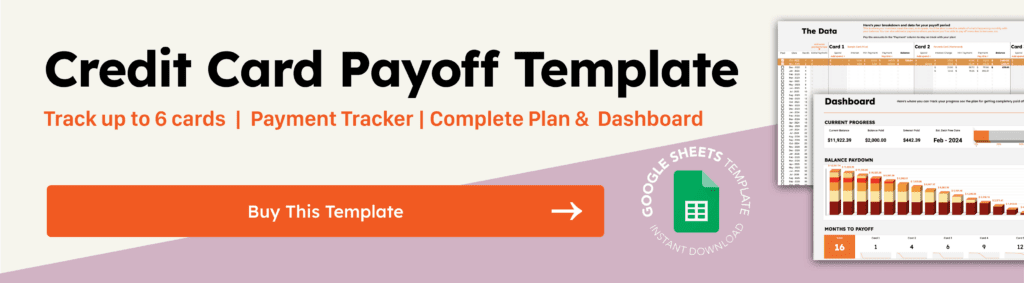

There is a Google Sheets spreadsheet built to help you get out of debt fast!

But first, let’s talk about the debt payoff methods and the pros and cons of each.

Snowball Method

There are two main methods for paying off debts: the Debt Snowball method and the Avalanche Method.

What is the debt avalanche method for paying off debts? In this method, you pay off the debts in order of highest interest to lowest interest ignoring the balances. This way you optimize paying the least in interest fees.

What is the debt snowball method for paying off credit cards? The debt snowball method focuses on motivation and momentum. Basically you pay off the smallest debts first, then the next smallest debt, and so on and so forth until you’re completely paid off while paying the minimum payments on the other debts.

The debt snowball method is the most popular method of paying down debt quickly, and for good reason! It’s very motivating to see the progress of being able to cross off a card as paid off and motivates you to stay on track.

In fact, several studies have shown it’s the most effective method for paying off debts like high interest credit cards

Credit Card Payoff Calculator in Google Sheets

How do you put the plan into action and track your progress? The Ultimate Credit Card Payoff template of course!

I’ve built an incredibly intuitive and powerful Google Sheets spreadsheet template built to help you build a plan to get debt free as quickly as possible!

This credit card payoff template allow you to enter up to 6 cards or debts and tracks up to 25 years of payments (hopefully you don’t need that long!). You can even put in balance transfer cards to see how they work for you.

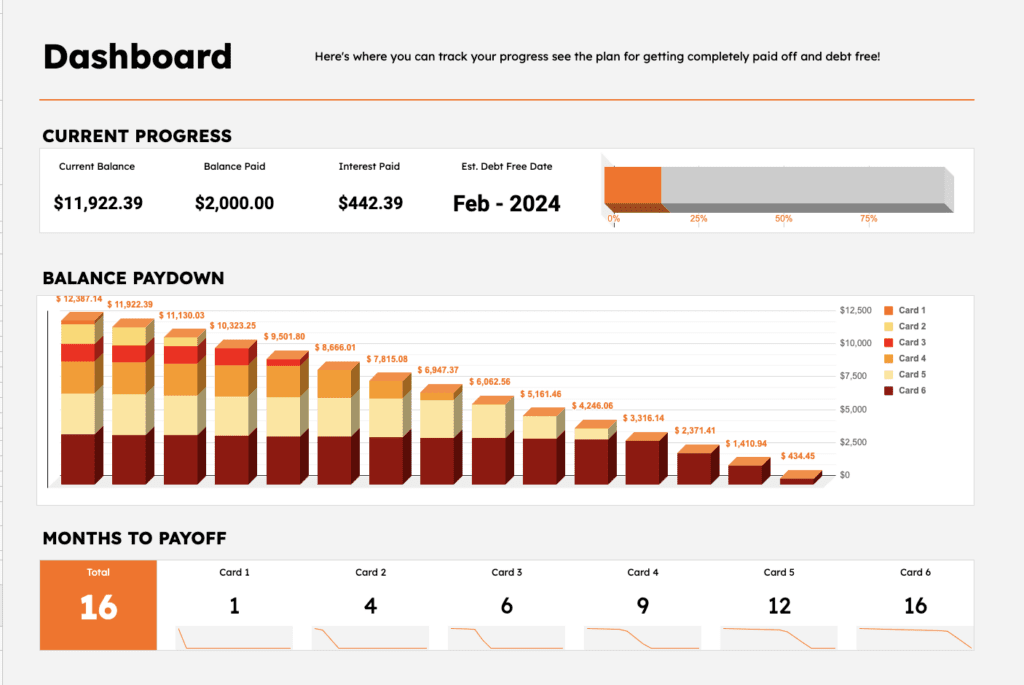

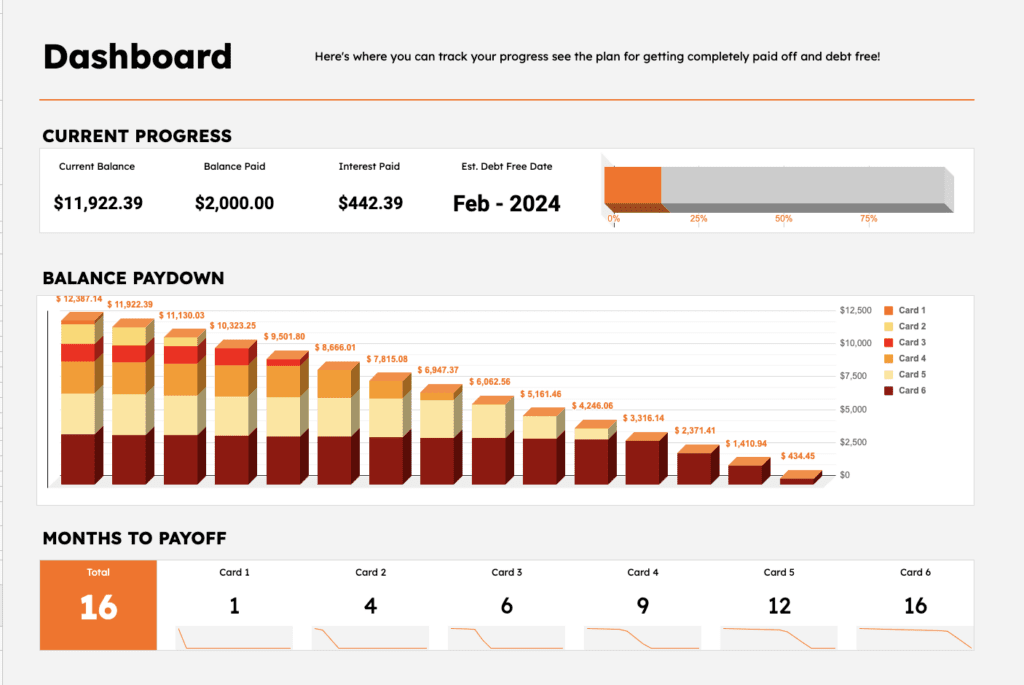

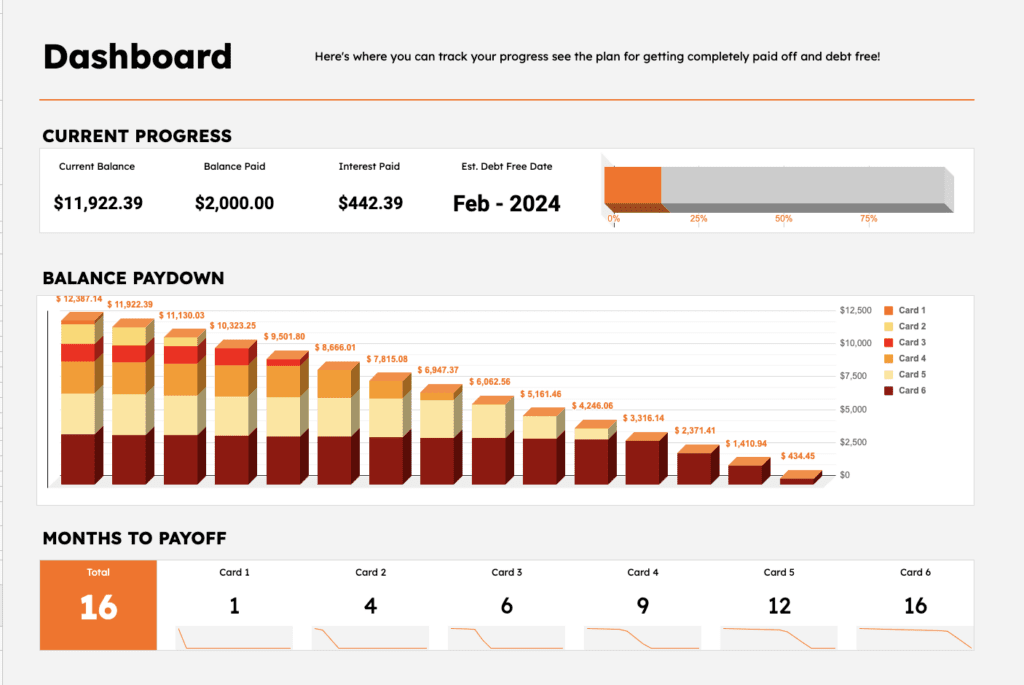

The dashboard in the template will show your payoff plan including how much interest you’ll pay, how long it will take, and even give you suggestions on how to pay it down more quickly.

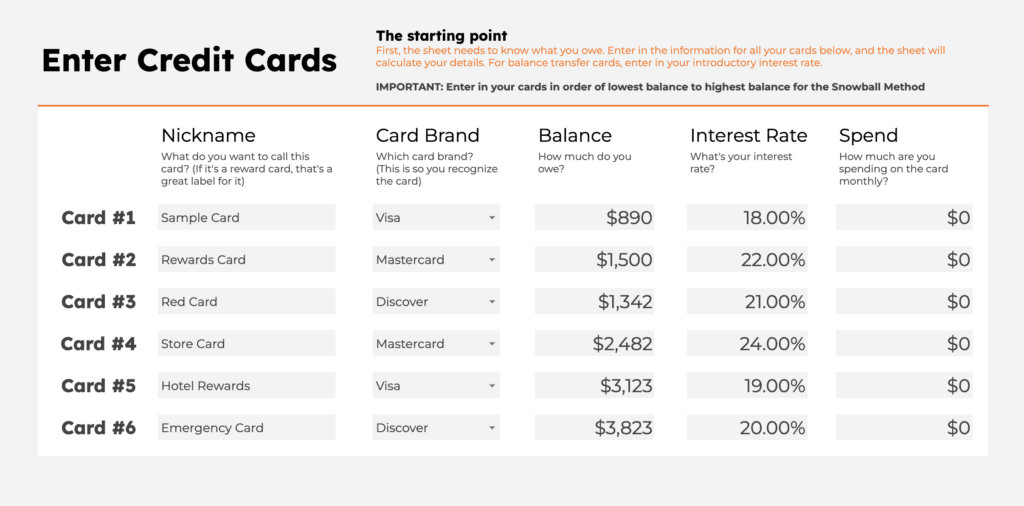

Step 1 – Entering Data

First step is buying the Credit Card Payoff Template for Google Sheets.

Once you purchase the template and copy it into your Google account, the next step is to enter your data.

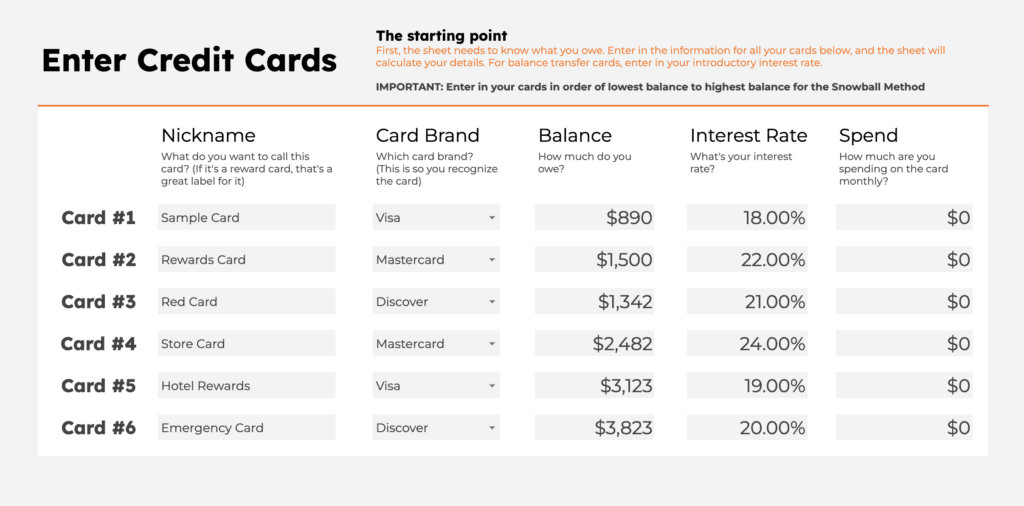

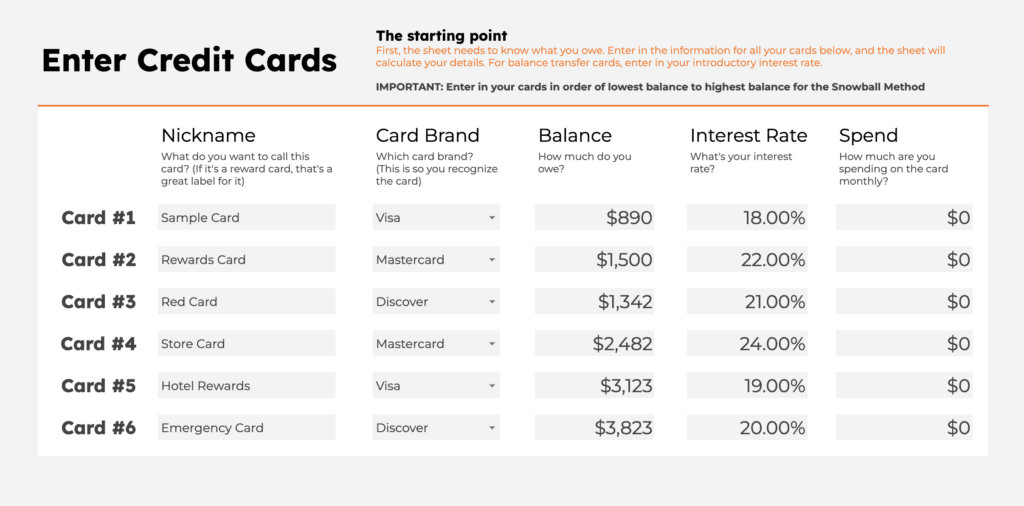

The spreadsheet accepts up to 6 cards. For each of your cards, enter in

- Nickname and brand (This is so you can recognize the card in other sheets)

- Balances

- Interest rate

- Monthly spend

The monthly spend is perfect for when you have subscriptions paid by the card and know a certain amount will always be added to the balance every month.

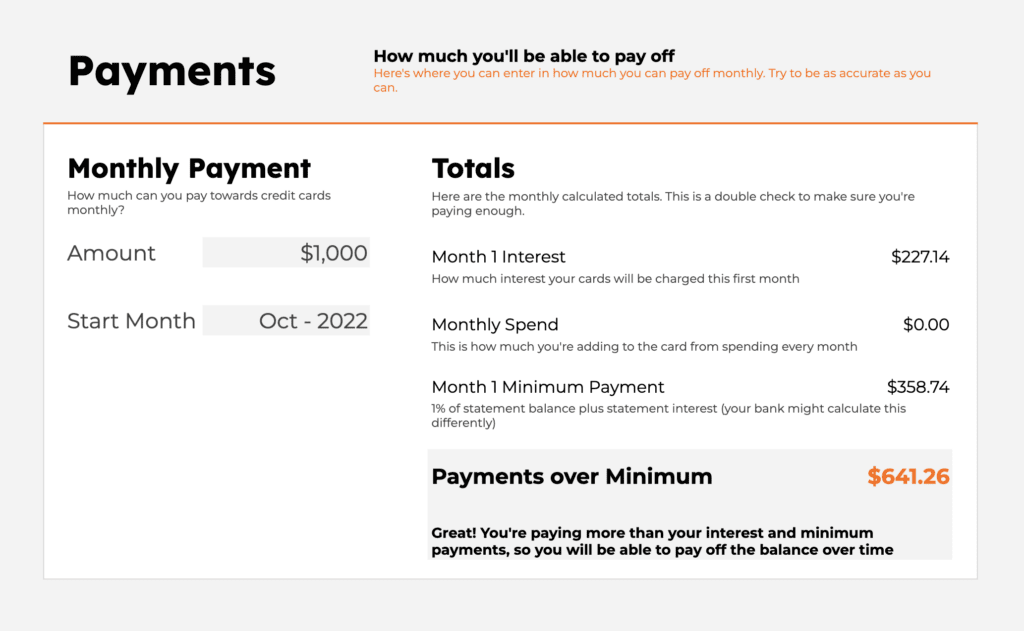

Step 2 – Enter Monthly Payment

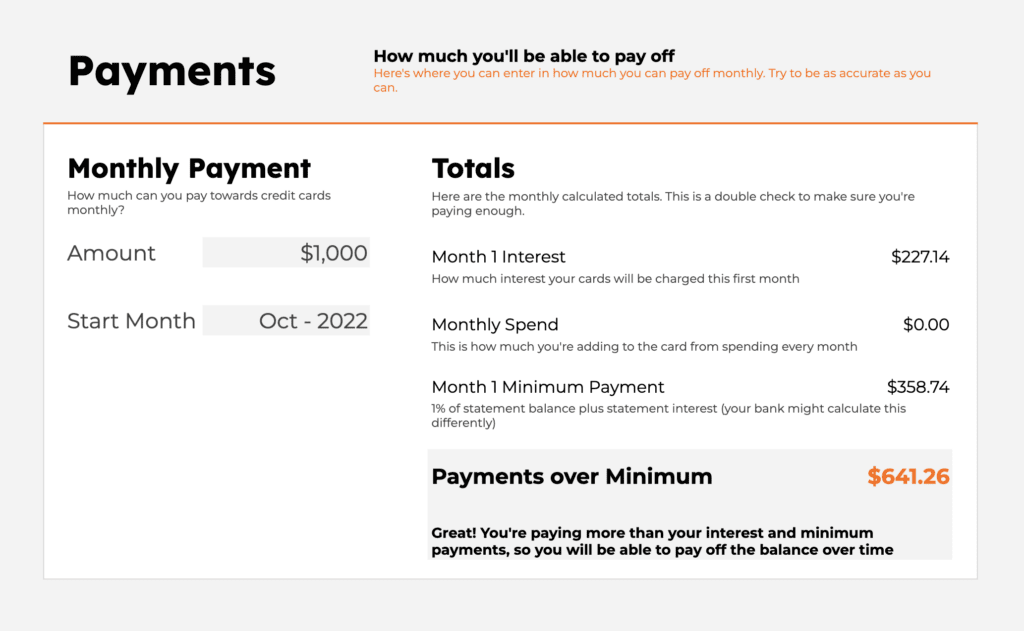

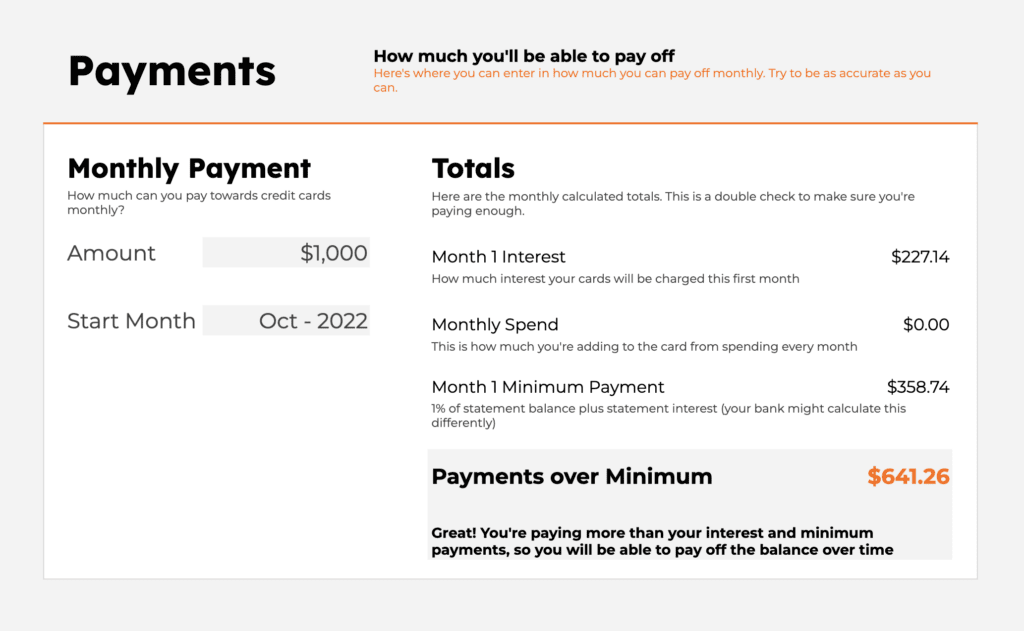

Next up, you can enter how much you can pay monthly towards your credit cards. The sheet is smart and will calculate your first month’s interest and minimum payments to ensure you’re at least paying enough to reduce the balance over time.

The Google sheet spreadsheet for credit card payoff template will give you a message letting you know whether you’re paying enough or need to pay more.

Selecting the start month will tell the sheet which month to start the dashboard and payment schedule on.

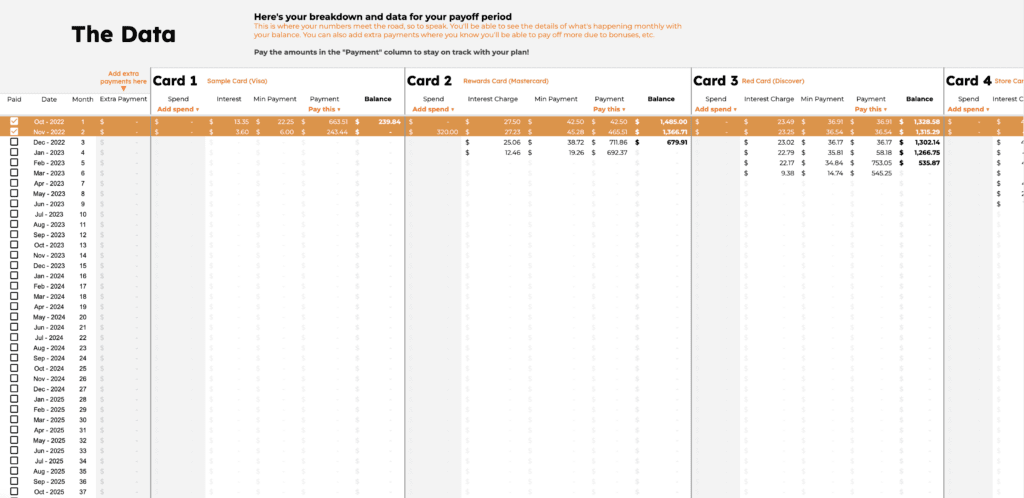

Step 3 – Follow The Payment Schedule

One of the most important sheets in the whole Credit Card Payoff spreadsheet template is the Data tab.

This sheet automatically calculates the interest fee, minimum payment, and amount you should pay. The sheet assumes you will be focusing on one card at a time and paying the minimum on all the rest of the cards.

The calculations give you how much to pay on each card to follow your plan.

In the 4th column you can add additional amounts you can pay that month like when you get a bonus or a gift. If you get a raise, you can just add that additional amount to each cell in that column. The sheet will automatically apply it to the card you’re paying down at the time.

For each card, you can also add additional spend over what you entered into the credit card data sheet. This will update your interest payment and the minimum payment, along with the rest of the data in the plan.

As you pay the amounts the sheet calculates to your credit card companies, click the checkbox on the left to update the dashboard with your progress!

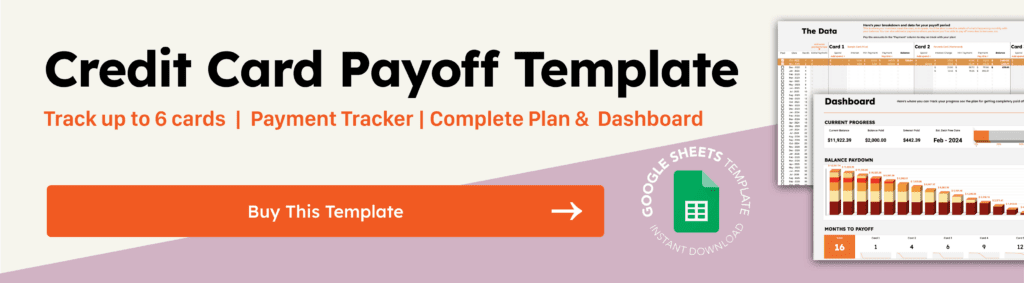

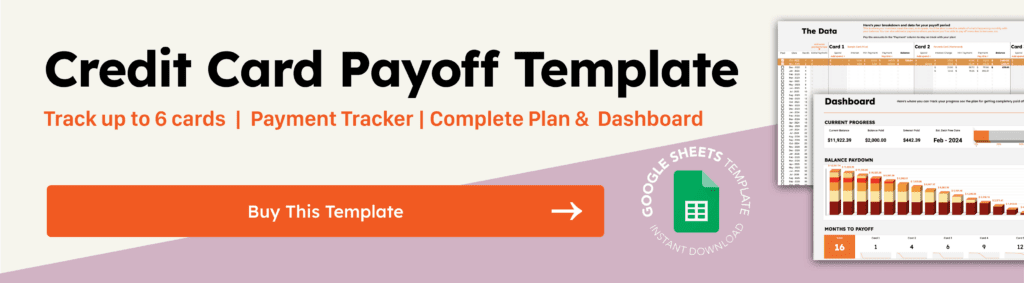

Step 4 – The Dashboard

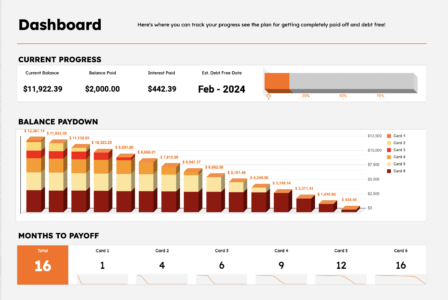

The final, and most fun step in this template to payoff your credit cards in Google Sheets is the Dashboard tab.

Here you can see your current progress, your estimated debt payoff date, a chart with your whole balance paydown plan, and the months to payoff for each card.

You can also see details like how much interest you’ll pay for each card, how much you’ll pay in total and on each card, and a box showing suggestions based on the data you entered.

Using this dashboard is how you’ll stick to the plan and get excited to watch your progress!

Crafting a plan

Once you have your basic data entered into the Google Sheets template, you can start to play with the payments, balances and interest to model different pay off strategies.

For example, what if you follow a combination of the Snowball Method and the Avalanche Method by paying off the lowest balance first to get momentum, then pay off the highest interest next to reduce fees?

What if you got a balance transfer card with a 0% interest for the first year and transferred some of your balance to that card?

You can put in these scenarios and look at the dashboard to look at your payoff time and total paid in interest to decide your best course of action.

How to model Balance Transfer Cards

Modeling a balance transfer card in this sheet is straightforward.

First, use one of the cards in the Credit Card Balances tab to enter in a 0% interest card. Then move some of the balance to the new 0% interest card and see how it impacts your payoff and interest paid.

For example, let’s say you have a card with $6,234 on it. This is what you’d enter:

| Card | Brand | Balance | Interest |

| High Balance Card | Visa | $6,234 | 24% |

Let’s say you knew you could get approved for a balance transfer card with a $5,000 limit and you wanted to see how that would impact your payments. You would add that card and move the balances like this

| Card | Brand | Balance | Interest |

| High Balance Card | Visa | $1,234 | 24% |

| Balance Transfer | Visa | $5,000 | 0 |

Now you can look at your dashboard and see what your plan looks like. The Data sheet will still calculate your minimum payment for your balance transfer card and apply it to your plan.

Getting debt free!

This Google Sheets template is the perfect tool for paying off your high interest credit cards and getting out of debt for good!

Using this spreadsheet you can figure out your best strategy and plan for paying off your cards as quickly as possible.

There are so many benefits of paying off your credit card debt

- You’ll pay less every month

- It will take weight off your shoulders

- You’ll lower your stress of paying monthly bills

- and most important, you’ll be able to use that money for investing and putting into retirement!

Good luck on your journey to being debt free! And if you use the template, please let me know how it helps you!