As a small business owner, managing your finances can be daunting. Let’s face it, you didn’t start your business to do accounting (unless you’re an accountant, in which case you did!). You started your business to do what you enjoy doing and make a living.

From keeping track of income and expenses to monitoring accounts payable and receivable, there’s a lot to keep track of and there is a never ending list of options for managing your bookkeeping. Luckily, there’s one tool that is my goto for straightforward accounting: Google Sheets!

Now, I know what you’re thinking. “Spreadsheets? That sounds boring and complicated.” But trust me, Google Sheets can be a secret weapon for your business bookkeeping. And the best part? You can add your own personality to your spreadsheets to make them uniquely yours.

Here are some tips for using Google Sheets to manage your business finances:

- Start with a template that matches your business needs. Google Sheets has a variety of free templates available, but often buying a premade template gets you the features and formulas you need to more effectively track your business finances.

- Keep it organized, but don’t be afraid to get creative. Use different sheets for different aspects of your finances, and label them clearly. But don’t be afraid to add a little flair to your spreadsheets, whether it’s color-coding or using emojis to highlight important information.

- Use formulas and functions to save time and reduce errors. Google Sheets has a variety of built-in formulas and functions that can make bookkeeping easier. Spend some time learning these functions, and you’ll be amazed at how much time you’ll save.

- Keep it up-to-date, but don’t be too hard on yourself. It’s important to update your finances regularly to stay on top of your business’s financial health. But if you fall behind, don’t worry too much. Just set aside some time to catch up and get back on track.

Benefits of Google Sheets

Now, let’s talk about the benefits of using Google Sheets for business bookkeeping over other accounting software options:

- Accessibility: With Google Sheets being cloud-based, you can access your financial information from anywhere with an internet connection. This means you can update your finances on-the-go, whether you’re working from home, the office, or a coffee shop.

- Collaboration: Google Sheets allows multiple users to access and edit the same spreadsheet simultaneously. This is especially helpful if you have a business partner or an accountant who needs access to your financial information.

- Automation: Google Sheets has built-in automation tools that can save you time and reduce the risk of errors. For example, you can use conditional formatting to automatically highlight cells that meet certain criteria, or use data validation to ensure that users enter data in a specific format.

- Integration: Google Sheets integrates seamlessly with other Google Workspace apps, such as Google Docs and Google Slides. This makes it easy to create reports and presentations using your financial data.

- Cost-effective: Google Sheets is free to use, which is a huge benefit for small business owners who may not have the budget for expensive accounting software or professional bookkeeping services.

- Scalability: As your business grows, your financial needs will become more complex. With Google Sheets, you can easily add new sheets, columns, and formulas to accommodate your changing needs.

What about other software?

Now, you may be wondering: “What about other accounting software, like Quickbooks?” While Quickbooks and other accounting software may offer more advanced features and functionalities, they can also come with a hefty price tag. Quickbooks, for example, can cost upwards of $300 per year. For small business owners on a budget, this may not be the best option.

Additionally, accounting software like Quickbooks can be complex and time-consuming to set up and learn. With Google Sheets, you can start managing your finances right away, without having to spend hours learning how to use a new program.

Of course, there are some downsides to using Google Sheets for business bookkeeping.

For one, it may not be as secure as other accounting software, since it’s cloud-based. You’ll want to make sure that you’re using strong passwords and two-factor authentication to protect your sensitive financial data. Additionally, Google Sheets may not be suitable for large businesses with complex financial needs.

But for small business owners who want a cost-effective and user-friendly solution for managing their finances, Google Sheets is definitely worth considering. With a little creativity and some basic accounting knowledge, you can use Google Sheets to keep track of your business’s financial health and make informed decisions about its future. Give it a try and see for yourself!

Looking for a built for you Google Sheets bookkeeping template?

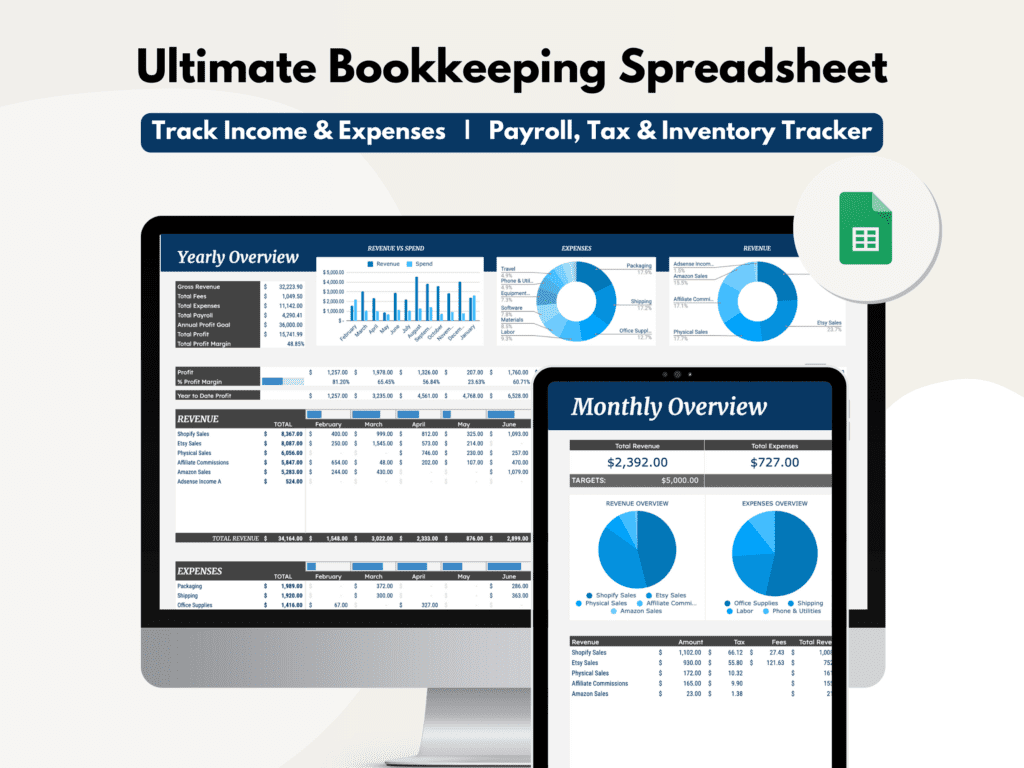

This google sheets template is already setup with every sheet, dashboard and formula you need to manage all your business finances

All-in-one Bookkeeping Template – Google Sheets

Introducing the All-In-One Business Bookkeeping Template for Google Sheets built to help you track all your revenue, expenses, inventory, and profits for your business and see key insights into how it’s performing.

This is the most comprehensive, best template with easy to read annual and monthly dashboard summaries to show your progress as your business grows and you hit your revenue goals!